Granlund achieved a good result in a challenging market situation

13.2.2024 – Even with the challenging market situation in the real estate and construction sector, Granlund made a good result in 2023. Strong customer relationships and special expertise supported the business, even in difficult times.

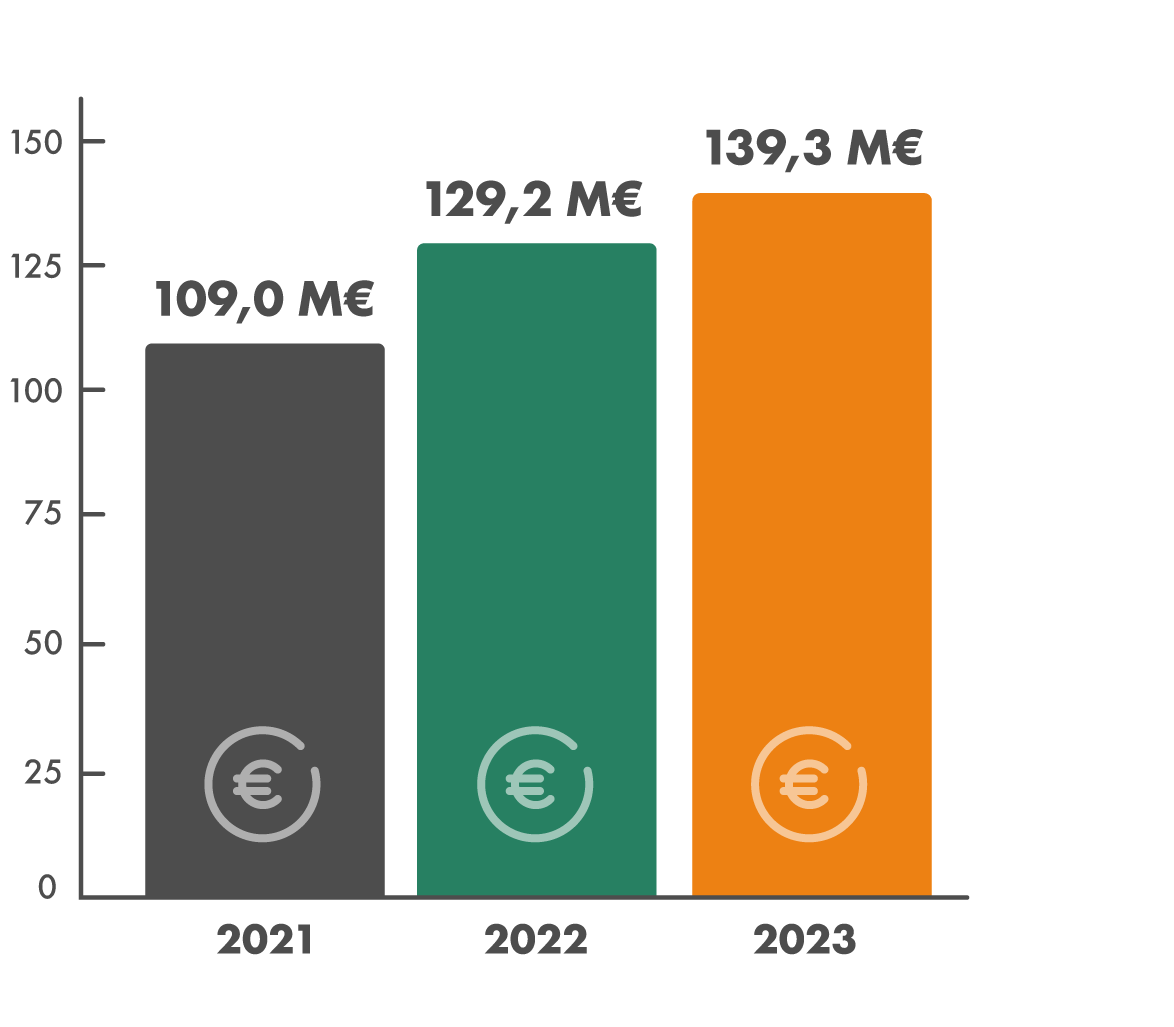

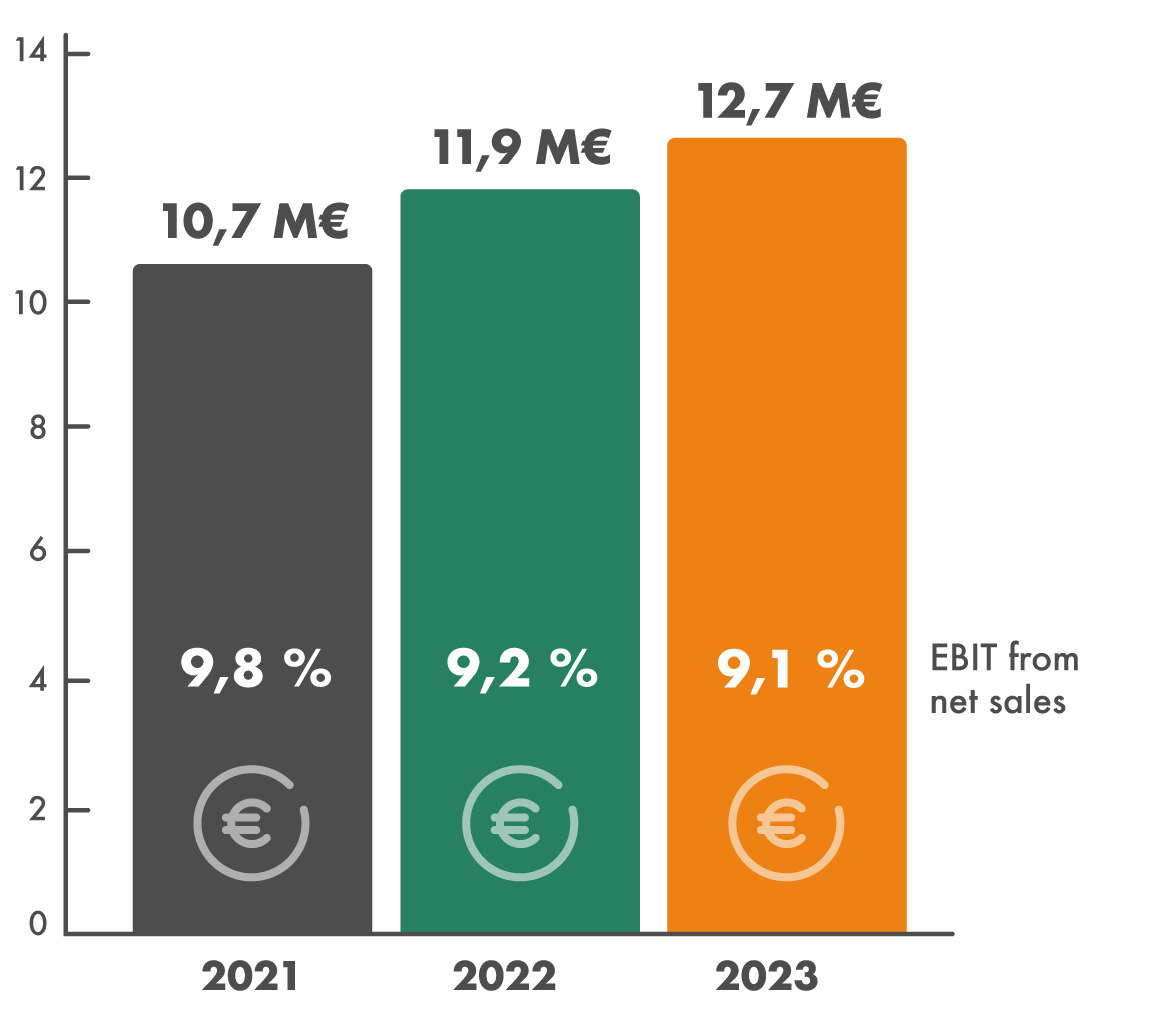

The Finnish market leader in MEP design, Granlund produced a positive result in a challenging market situation. Granlund’s net sales increased by 8 % year-on-year, to EUR 139.3 million (EUR 129.2 million). The operating profit was EUR 12.7 million (EUR 11.9 million). The growth targets were not achieved, but the overall result was quite good.

“Our specialisation and focus on MEP-oriented projects, such as energy repairs, data centres and hospitals, also brought results in the more demanding market. There was also strong demand for property management services as well as sustainability and energy consulting,” says Pekka Metsi, CEO of Granlund.

Granlund has also continued its significant investments in digital solutions, which is reflected, for example, in the record-breaking growth of the software business. “A year ago, we set up our own data unit to develop the data-driven approach of the Group and its business operations. Digital solutions can make a significant contribution to improving the productivity of the industry,” adds Metsi.

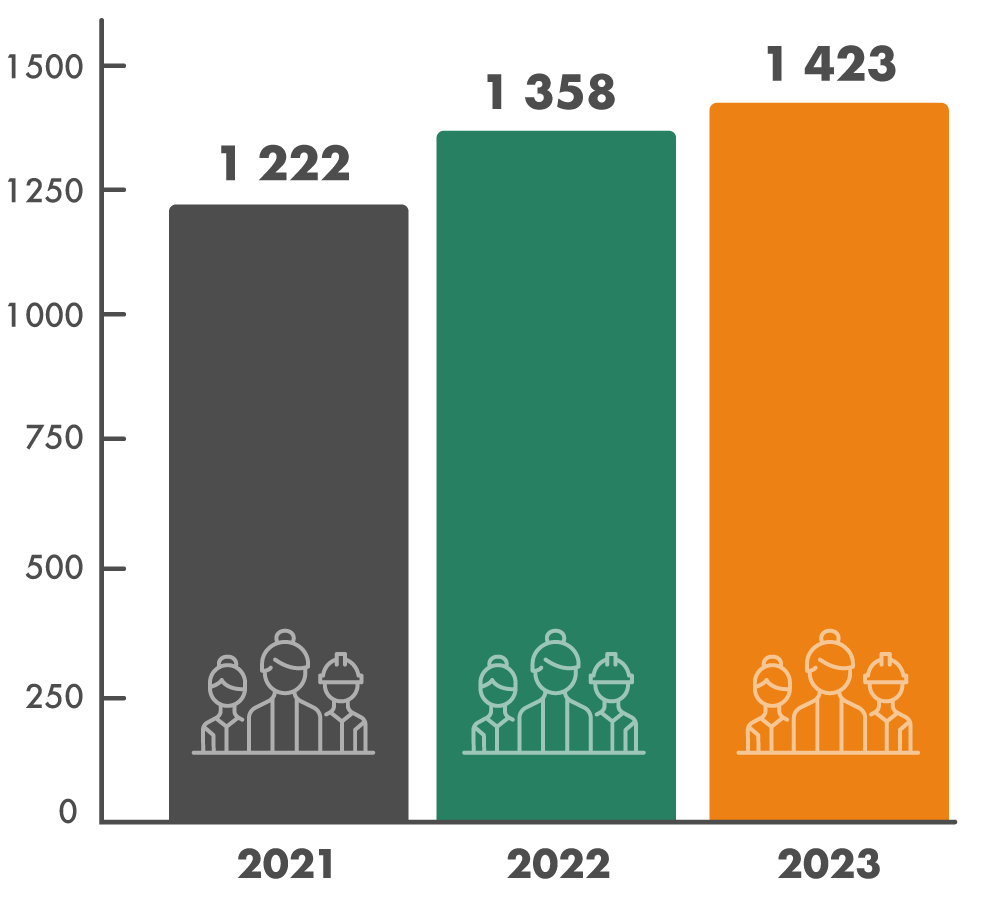

Granlund had 1,423 employees at the end of 2023, an increase of 65 from the previous year. “We managed to maintain quite a good workload throughout the year. Of course, there were variations between functions and regions,” Metsi says. “This good result was achieved with hard work and an active approach, for which we would like to thank all of our experts,” he adds. A total of €3 M in performance bonus is paid to the staff.

Our specialisation and focus on MEP-oriented projects, such as energy repairs, data centres and hospitals, also brought results in the more demanding market. There was also strong demand for property management services as well as sustainability and energy consulting.

Pekka Metsi, CEO, Granlund Group

In the acquisition front Granlund was more active in the end of the year

On the acquisition front, Granlund became more active towards the end of the year. Granlund made transactions with Projektivisio Oy, a company specialised in hospital design, and an architectural office Arkkitehtitoimisto ON Oy. At the beginning of 2024, acquisition of a construction management company Rakennuttajatoimisto Rantatupa Oy was confirmed.

The organisation underwent a major reform when Granlund’s 12 regional companies were merged into the parent company in October. The merger will help the company prepare for stronger growth, both in Finland and internationally. Granlund’s strategic goal is to double its net sales and personnel by 2027. The aim is to expand mainly to Scandinavia and some other select parts of Europe.

“In Finland, we have expanded significantly not only through organic growth but also through acquisitions. Now, we also want to accelerate this growth internationally, aiming for larger arrangements abroad,” says Metsi, commenting on the growth plans. Granlund’s strategic strengths will help drive the growth. “We will continue to focus on our specialisation and provide our customers with services for the entire lifecycle of the property. Our strengths also include a great working atmosphere and an entrepreneurial attitude. In these aspects, we want to be the number one player at the European level,” says Metsi.

Development and business overview

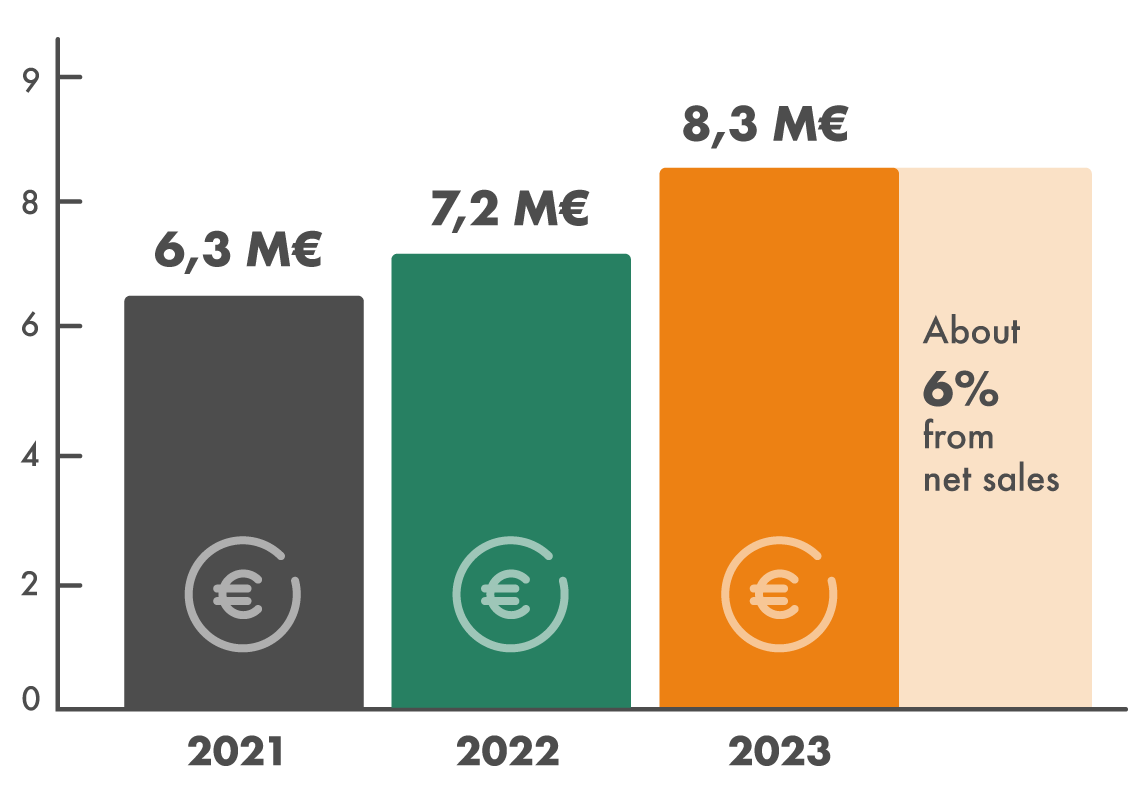

The company continued to strongly invest in innovation and development. In the previous year, Granlund’s innovation and development investments amounted to EUR 8.3 million, about 6% of consolidated net sales. The innovation activities focused on Granlund’s strategic growth areas, in other words energy, sustainability, data and digitalisation. These themes will continue to be promoted in 2024.

Granlund’s design business had a good year, considering the challenging market situation. The volume of orders remained at a good level, and as in the previous year, the public and commerce sectors continued to be active. Lifecycle projects, data centres and energy efficiency projects were actively carried out. The volume of hospital projects increased at the end of the year.

In consultation, the operations developed favourably. The property management market saw growth, even though the number of real estate transactions dropped from the usual level. There was a great deal of demand for energy and sustainability services. This was influenced by, among other things, the emphasis on the criteria for sustainable investments, the need for energy efficiency measures and the requirements for sustainability reporting that are increasing due to EU legislation. More extensive sustainability steering was also needed for construction projects.

In software business, Granlund Manager considerably strengthened its position as the most used property management system in Finland. Record-breaking profits were made in sales and business operations, and annual recurring revenue (ARR) increased by 27%. The revenue from integration and reporting solutions between software grew by almost a third. Integrations and lifecycle data management are expected to continue to grow as the industry prepares for the new Building Act.

The order volume of construction management and supervision is seeing an upward trend. Public-sector construction. data centre projects, industrial projects and various turnkey deliveries laid the foundation for the business. In renovations, the average size of projects was smaller, but the constant flow of repair projects commissioned by loyal customers continued at a steady pace.

In the Helsinki Metropolitan Area, property management services developed positively in terms of both growth and profitability. Long-term customer relationships also supported the activities in this sector.

More information

Pekka Metsi

More news from us

Subscribe to our newsletter

Be among the first to hear about the latest news and trends relating to Granlund and the real estate and construction sectors.