Key figures and strategy

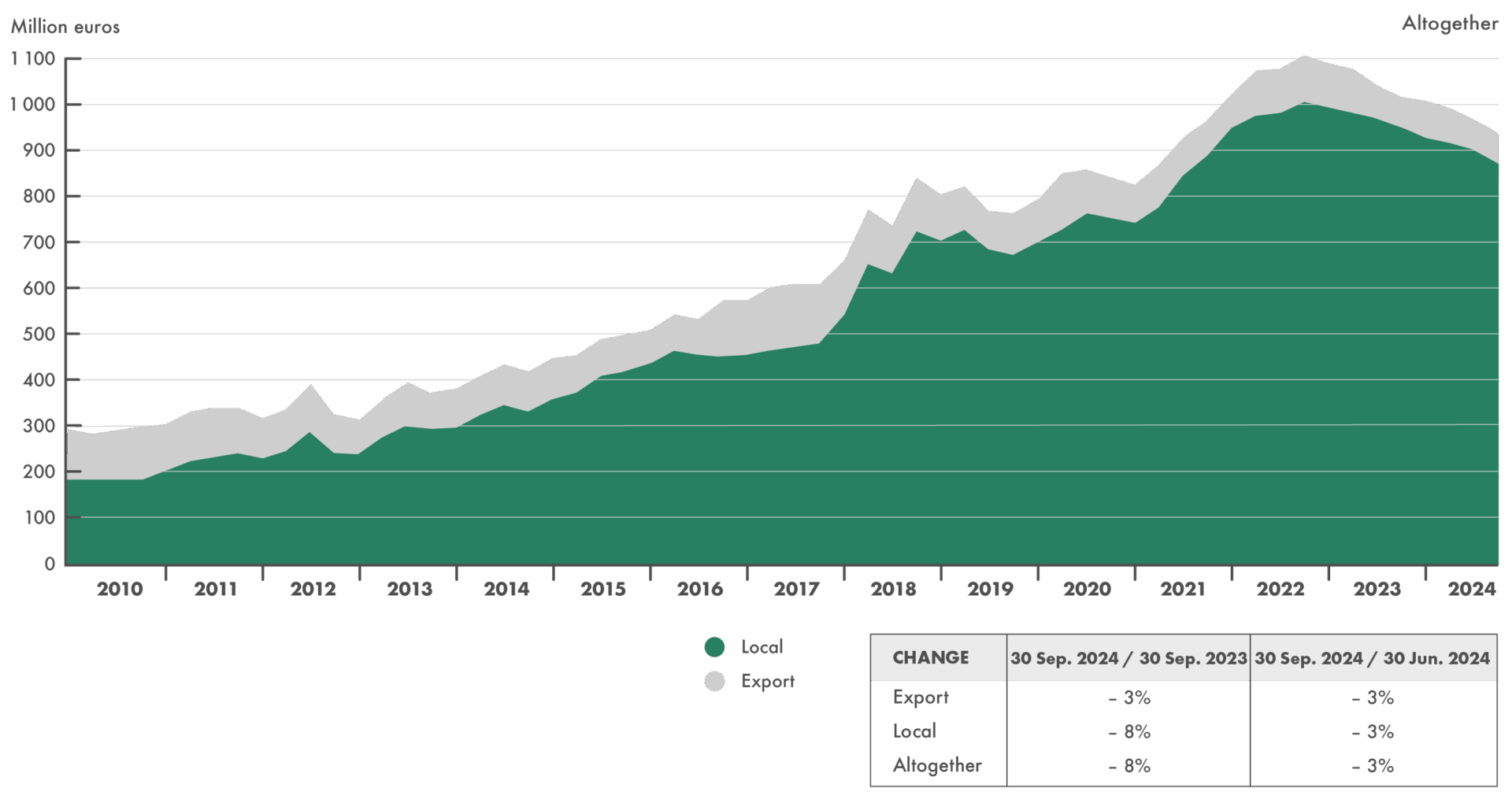

Granlund achieved a positive result in 2024 in a challenging real estate and construction market. Data center projects, renovation, software and public sector projects continued to provide employment even in a more difficult economic climate.

Key figures

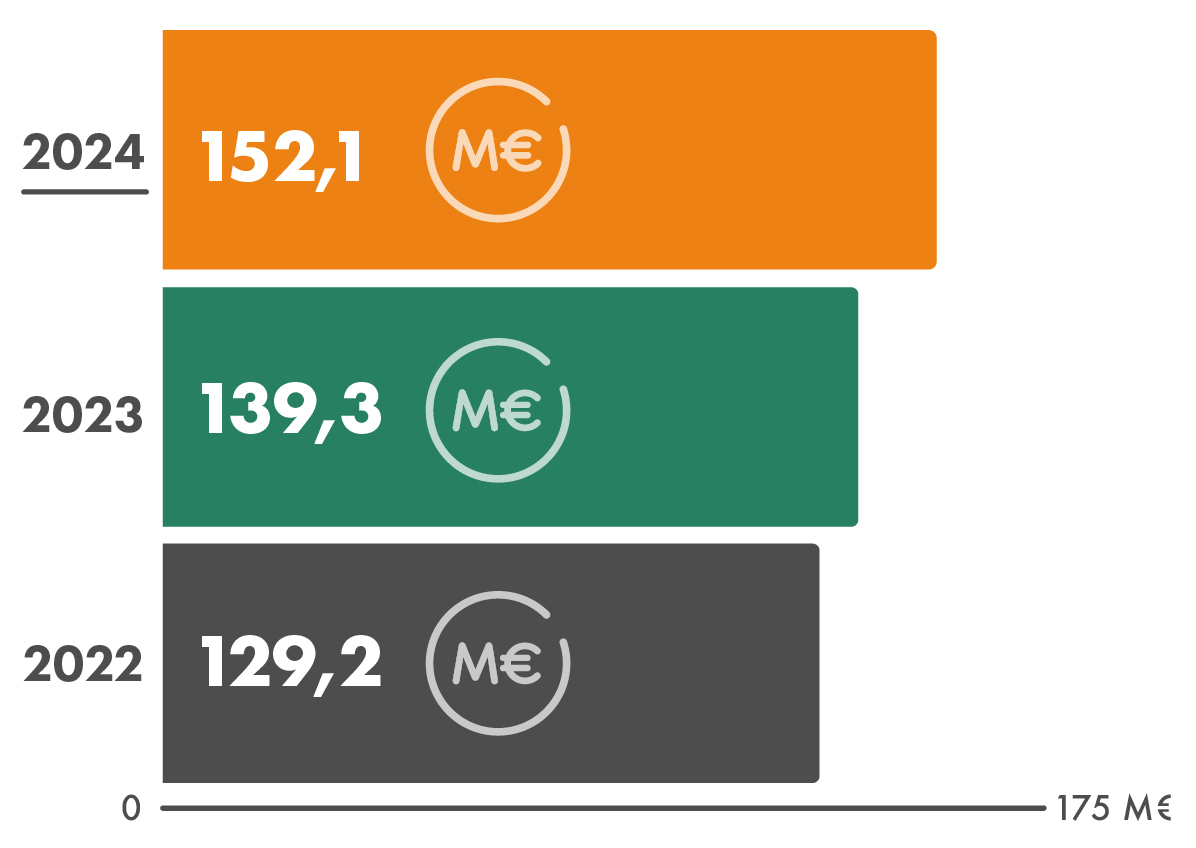

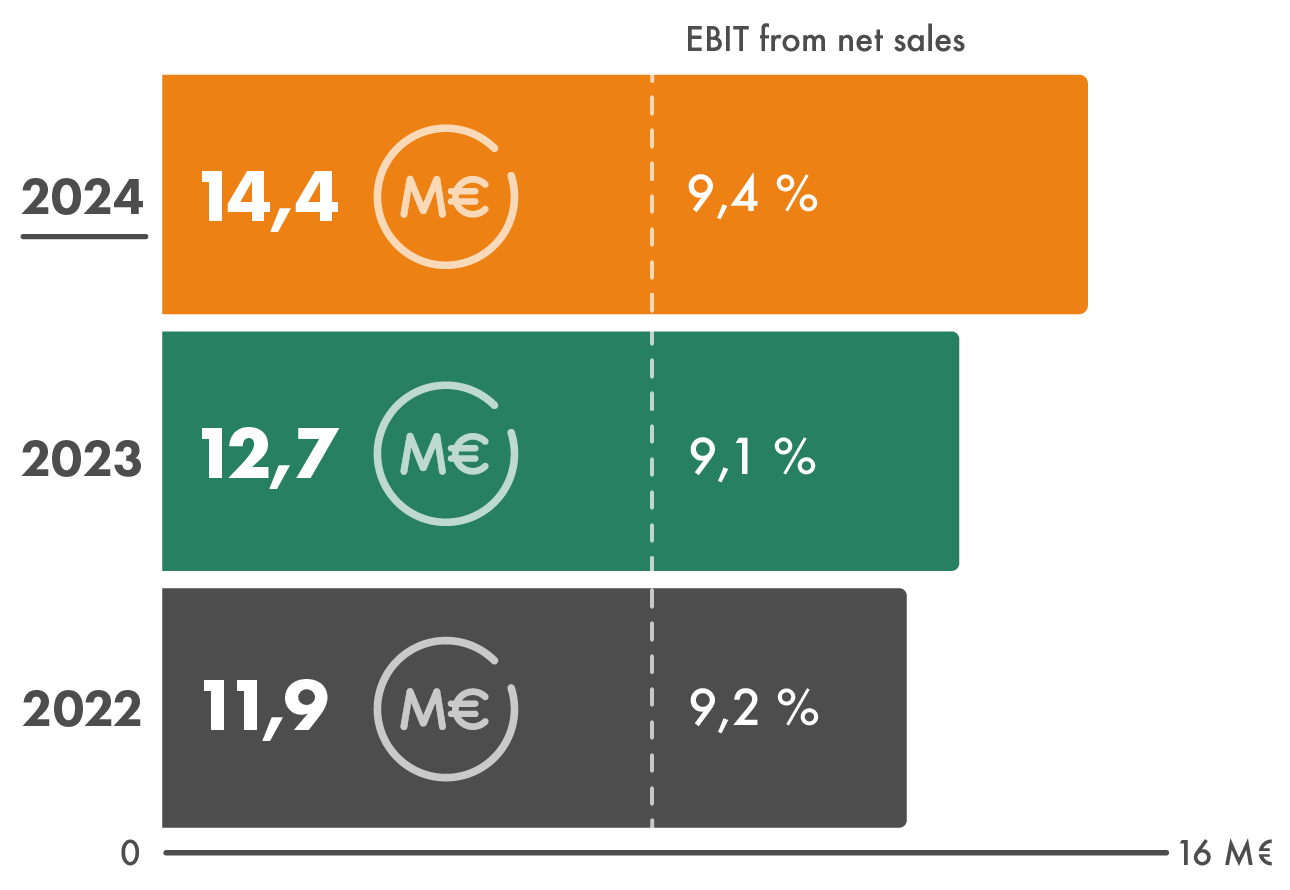

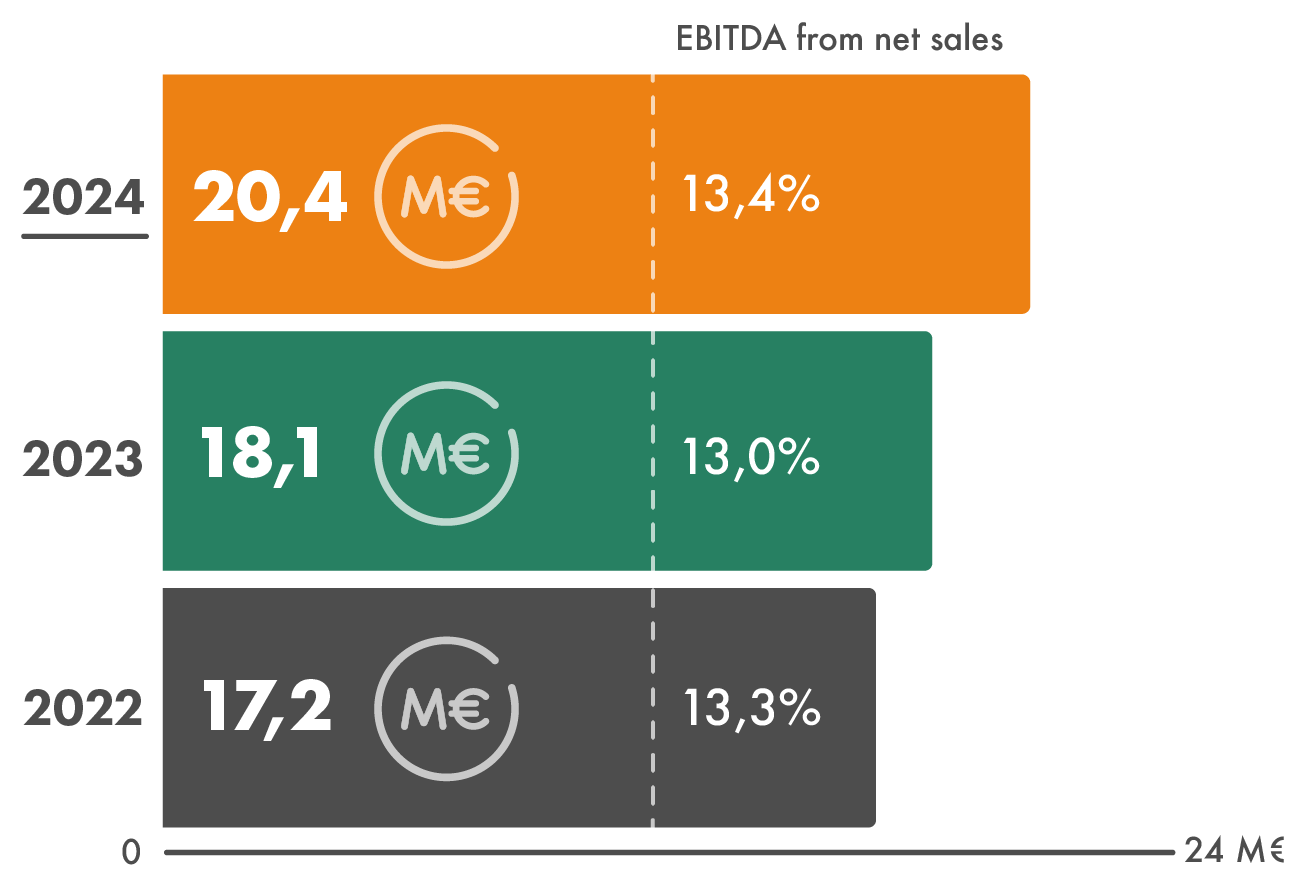

In 2024, Granlund performed well and continued its growth in a challenging market situation. The Group’s net sales increased by approximately 9% year-on-year to EUR 152.1 million. EBITDA was EUR 20.4 million and the operating profit was EUR 14.4 million.

The growth was rendered possible by Granlund’s strong customer relationships and expertise in technically challenging projects. The data center sector saw record growth, with both construction management and supervision as well as the software business increasing. Projects had a higher emphasis on renovation than new construction.

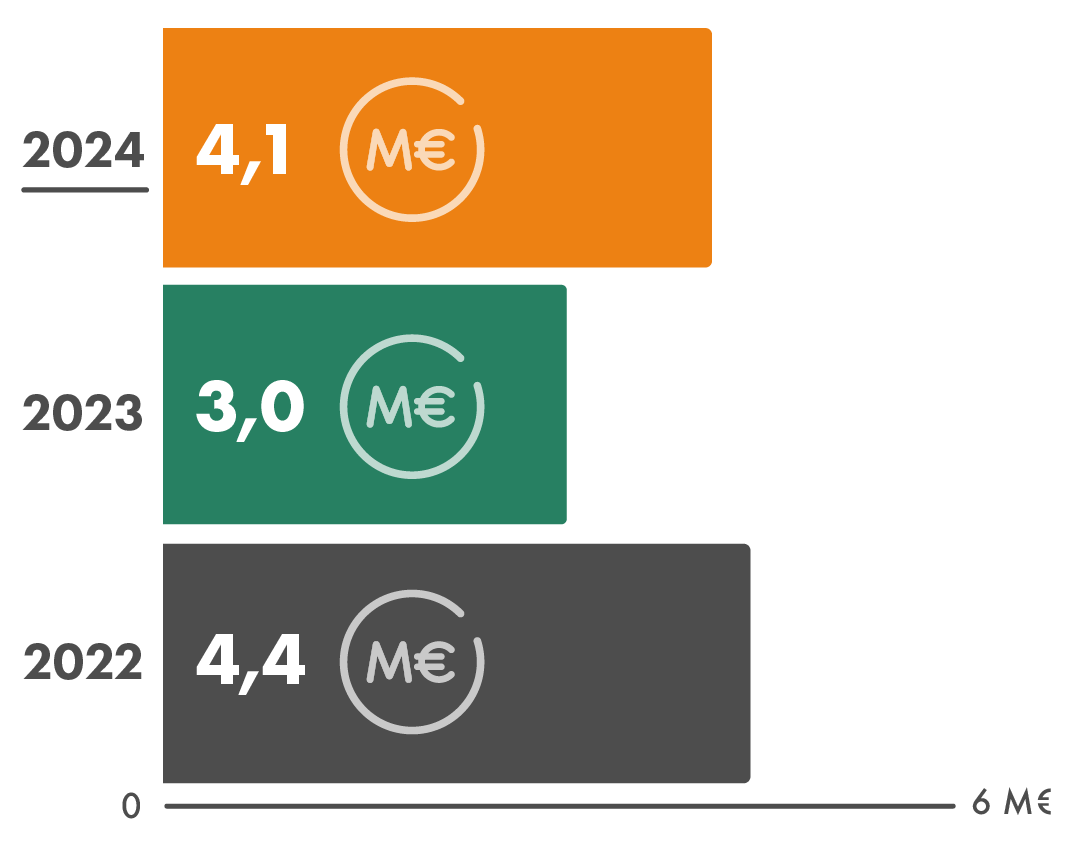

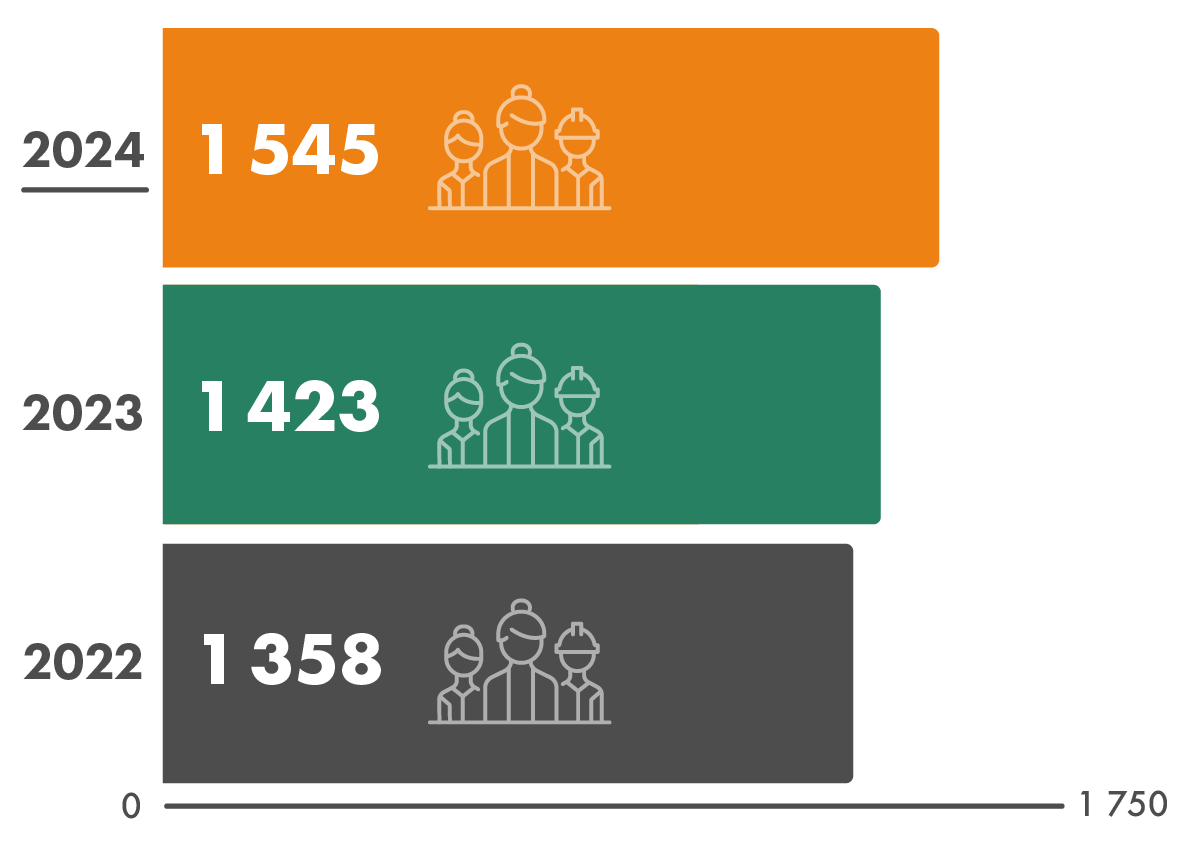

Recruitment hit record numbers, with the number of employees increasing by more than a hundred experts during the year. At the end of 2024, there were 1,545 employees. In total, approximately EUR 4.1 million was paid out to the personnel in profit-related bonuses.

CEO’s review

2024 was a very challenging year for the real estate and construction sector. Interest rates, consumer distrust and a difficult financial situation kept the general mood in the market subdued, and the weakness of the housing market was reflected in many industry operators. There was plenty of talk about investment in green transition, but practical action was conspicuous by its absence.

A bright note in 2024 were the active development operations in the real estate and construction sector.

Pekka Metsi, CEO, Granlund

The design and consulting industry probably came through the difficult year somewhat better than contracting. Although many design companies had to resort to layoffs and redundancies, the continuity of operations was not at risk, except for a handful of companies. Contractors, on the other hand, faced an increasing number of bankruptcies and companies entering liquidation. Traditional housing construction stalled more than infrastructure and industrial construction.

The poor economic situation also affected the labour market. The unemployment rate in the construction industry was at its highest level in a long time. On the other hand, the situation also enabled new recruitments for some of the companies in the sector.

Lively development operations in the real estate and construction sector were a positive, and Business Finland remained as active as ever in financing development projects. Real estate and construction industry operators worked together to develop, amongst other things, data-driven operations and the standardisation of design data. More and more contractors were trying out takt time production and utilised data in work planning and logistical planning. Designers and contractors also worked in closer cooperation.

The data center sector ranked number one

Granlund’s net sales improved in most business areas, with the highest achievers of the year being data center design, construction management and supervision as well as property software. In other businesses, the public sector, renovation and key government projects were excellent sources of employment.

We maintained our market leader position in MEP design and contributed actively to the development of the sector, for example, through the Talotekniikka 2030 programme (MEP 2030 programme). In line with our targets, structural and architectural design grew as newer businesses and we also made some new headway in industrial design.

The data center sector is becoming Granlund’s largest single business area, which was positively reflected in our work in many different areas. In addition to design and consulting, data centers also kept many of our construction management and supervision professionals busy.

International growth

First and foremost, our business growth was enabled by our loyal long-term customers and our strong expertise in technically demanding projects, such as data centers, hospitals and high-security properties. Our international growth also gained momentum when the investment company ICG became a minority shareholder in Granlund in the summer. At the end of the year, there were also some changes taking place in Granlund’s Board of Directors.

We grew both organically and through acquisitions, with a total of five acquisitions completed during the year. The acquisitions supported our strategic growth goals, especially in architectural and structural design and construction management.

In internationalisation, we are banking on the same strengths we are famous for in Finland. We want to be especially strong in the customer sectors supported by our technological, energy and sustainability expertise.

A wait-and-see year in consultancy

The reductions in state energy subsidies came at a terrible time. Combined with a record low number of property sales, the effects were clear to see in the demand for Granlund’s consulting services. In fact, the atmosphere in expert services was generally one of “wait and see” and price competition was savage.

Our consultants were mainly kept busy by the continuous services offered to our regular customers. In sustainability consulting, the market was stimulated by stricter legal requirements, such as CSRD reporting, which puts pressure on companies and property owners to develop data management and automate processes. There is also ongoing demand for business intelligence services.

Granlund strengthened its ownership base – ICG as a new investor

Granlund announced a new partnership with global alternative asset manager, ICG. The company joined as a new investor, to provide to help accelerate Granlund’s international growth and expansion.

“Granlund’s strategic goal is strong internationalisation in Scandinavia and Europe. ICG is a partner able to support us on this journey”, says Pekka Metsi, CEO of Granlund.

Increased appreciation for data management

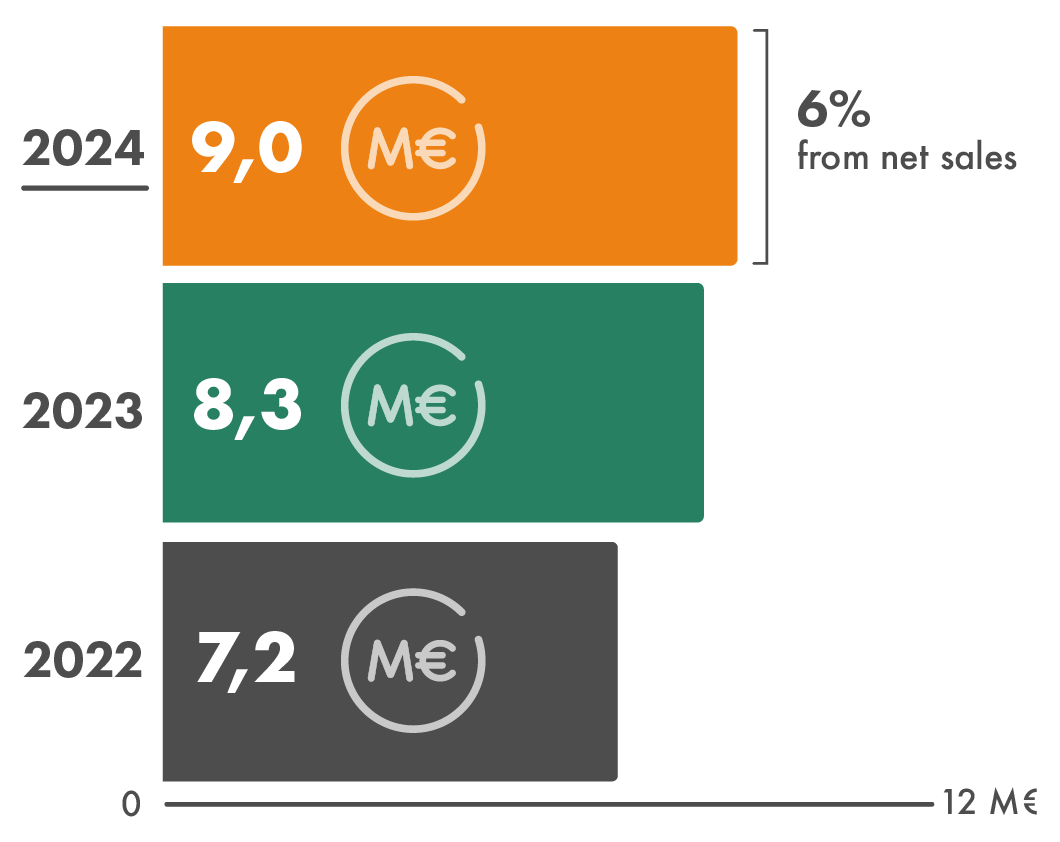

The recession of the construction sector was not visible in Granlund’s innovation and development operations. As usual, we invested approximately 6% of our consolidated net sales in innovation. The main themes of development work were the digital green transition, data management, energy and improving productivity.

The appreciation for data was positively reflected in the property software market. Many operators sought to improve their productivity with software solutions. Especially in the public sector, old systems were upgraded to new ones. Artificial intelligence was also used, at least in pilot projects. Granlund Manager remained the most popular property management software in Finland.

Granlund Manager maintained its position as the most popular property management software in Finland.

Pekka Metsi, CEO, Granlund

Happy employees and customers

Our goal is profitable growth and maintaining our high level of employee and customer satisfaction. The results of the customer satisfaction surveys, brand surveys and personnel survey carried out last year were excellent. Roughly 94% of Granlund employees are happy with their workplace. On a scale of 1–5, our overall customer satisfaction score was 4.08.

Even in challenging times, we want to invest in future talent together.

Pekka Metsi, CEO, Granlund

Customer satisfaction has increased in all areas and different businesses. In particular, customers appreciate the competence of our experts, their ability to understand customer needs, high quality and sustainability. Our leadership culture also convinces: we believe in a low hierarchy and decision-making at the local level.

Moving forward, it is vital to maintain our good reputation as employer both in Finland and in new market areas. For young experts, their first impressions of the real estate and construction sector are crucial. And that’s why one of the absolute highlights of the year was the high number of internship opportunities provided by us as well as other industry operators. Even in challenging times, we want to invest in future talent together.

Positive outlook for 2025

We believe in positive development in several businesses in the coming year. Our goal is to maintain our strong position in MEP design, the data center sector and property software. We are expecting to see growth in areas such as architectural and structural design as well as sustainability, data and digitalisation expert services. There will also be further opportunities for growth in project management and construction services, especially in technically demanding projects.

Although, as we are entering the year 2025, the markets are not expected to recover that quickly, we believe that there will be at least a slight upturn as we move towards autumn. Currently, the biggest threats to business are connected to the global situation at large and international crises.

Pekka Metsi, CEO, Granlund

Strategy and operating environment

Granlund’s Plan G+ strategy aims for bold international growth and the strengthening of its current main business areas. The company is also developing its architectural and structural design services and is seeking an even better position in its key sectors.

All operations aim to improve the sustainability and productivity of the real estate and construction sector. One of the main ways is to streamline data flow and business intelligence, which creates new opportunities for both construction and the property lifecycle. The aim is to be an attractive and reliable employer both in Finland and on the international market.

Granlund mainly achieved its strategic growth targets in 2024, despite the challenging market situation. Close cooperation with customers and other stakeholders plays a very important role in our success. A sustainable and smart future is achieved together.

In internationalisation, Granlund’s strategic goal is to develop into a truly international company over the next five years. The aim is to grow both in Scandinavia and in a few select European countries. In 2024, internationalisation was particularly supported by the global alternative asset manager ICG becoming a minority shareholder in Granlund. The majority of the ownership base will continue to consist of nearly 300 owner partners.

Internationalisation relies mainly on the same strengths as in Finland. Granlund wants to be particularly strong in those customer sectors where growth can be seen and which are supported by the company’s technology, energy and sustainability expertise. Added value is also generated through data-based services that support business intelligence and productivity. A special characteristic of Granlund is the ability to combine the expertise and resources of a large company with local agility and decision-making.

Granlund’s strategy aims for growth in design, services and consulting, software and construction management and supervision. Strong market leadership in MEP design and property software creates opportunities to develop the business, for example by expanding the company’s own role and creating new digital services. Stronger growth is sought especially in architectural and structural design as well as construction management and supervision.

In design, the growth targets were clearly exceeded in data center design, and structural and architectural design also grew in line with the targets. In the future, data-based activities and associated new services will be developed in particular. At the same time, design processes will be automated and productivity improved.

In accordance with its strategy, Granlund has grown into a national operator in construction management and supervision, supporting project management with data-driven services, such as cost, schedule and carbon footprint management. In addition to net sales growth, strategic successes included expanding services to all of Granlund’s business units and improving general awareness.

Consulting services emphasise business intelligence, and Granlund offered its customers efficient digital and AI-based tools for energy, sustainability and property management. The importance of data management was also reflected in the software business, which achieved the growth targets in all areas. Both businesses secured several dozen new customers, many of which use both Granlund’s property software and expert services that support their use.

Net sales and profitability improved in line with strategic goals in real estate management.

A project to clarify the Plan G+ strategy was launched in December 2024. The aim is to further clarify the growth targets and focus areas of the Group and its various businesses. The financial targets will be set until 2029. Concrete action plans for the next three years will also be defined.

The data center business is growing fast

Granlund has grown to become the largest expert company specialising in data center design and consulting in the Nordic countries.

During the year, the data center business grew by a record 60%. Besides tech giants, projects in Finland and other Nordic countries were launched by a completely new type of industry operators whose algorithm-based and AI-based business requires dedicated data centers.

Construction management is enlarging

At Granlund, construction management and supervision are growing at a nice rate. Last year, we achieved record net sales of €24 million. The year-on-year growth was as high as 39% (25% in 2023).

Customer satisfaction also remains high, and the number of employees increased considerably in the previous year. In Finland, we now offer construction and supervision services nationwide.

Granlund’s data strategy

Granlund’s data strategy was updated during the year, as data management and data-driven services related to properties and construction have grown to become a significant part of Granlund’s business in line with the objectives of the Plan G+ strategy. Underlying this is the digitalisation of society and the development of artificial intelligence. High-quality data is needed to improve the efficiency of internal operations as well as solve productivity and sustainability challenges in the real estate and construction sector.

Granlund’s goal is to be a pioneer in data-driven operations. The data strategy shapes a direction for new services and the use of data in different business operations, from planning to consulting and construction management to software development. In addition to our own business, we want to promote change more extensively in the maintenance and construction value chains, which creates opportunities for wider cooperation and internationalisation.

Customer-centric development

Data-driven services are developed close to customers in the strategy projects of different businesses.

The experts and customers are supported by Granlund Data Office, which offers technology solutions and help with the commercialisation of services. It also ensures that the use of data in projects is efficient and secure.

The businesses also receive support from Granlund’s innovation department, which helps to utilise the latest emerging solutions.

The long-term goal is to develop Granlund into a data-driven company. This is achieved when the organisation evolves and develops activities together.

Innovation and development activities

Granlund’s innovation and development activities involve multi-level cooperation with its own business units, customers and partners in Finland and internationally. In 2024, EUR 9 million was invested in innovation and development, which represents around 6 % of Granlund Group’s net sales. The principal development themes were the digital green transition, data management and energy.

The principal development themes in 2024 were the digital green transition, data management and energy.

Internal innovation work focused on strategic cooperation projects with different business units during the year. Cooperation was also carried out with educational institutions and young experts, for example, in the Junction hackathon. A record number of theses were completed during the year, 32 (25 in 2023).

Granlund participated in the industry’s most significant co-development projects, such as the Talotekniikka 2030 programme and the Building 2030 consortium, as well as in the operations of communities such as KIRAHub. The IHDA alliance promoted the export of hospital design expertise to the world. Many Business Finland projects ended at the end of the year, but funding was also received for new projects.

The preparation of Business Finland’s extensive DigiChamp development programme (2025–2027) began during the year. The programme supports Granlund’s strategic growth goals and includes seven individual projects. Several research institutions and companies from the real estate and construction sector and the IT sector are involved in the preparation. At the end of the year, funding was secured for one project.

Mobile app for collecting equipment data developed at the Junction hackathon

As part of the NSDC and Untangling people flow development projects, Granlund and KONE conducted a joint data challenge at the Junction hackathon. 26 teams participated in the challenge. The winning idea was a user-friendly mobile application that automates equipment inventories, i.e. the collection of information about the equipment stock in buildings.

EU and Business Finland projects

Projects completed in 2024

- E3 (Excellence in Pandemic Response and Enterprise Solutions, 2021–2024)

- DHC-Hybrid (Research and demonstration of key technologies of DHC hybrid system based on renewable energy heat pump, 2021–2024)

- IML4E (Industrial Machine Learning for Enterprises, 2021–2024)

Ongoing projects

- NSDC (Nordic Superblocks as Decarbonization Catalysts, 2023–2025)

- GenerIoT (Generating and Deploying Lightweight, Secure and Zero-overhead Software for Multipurpose IoT Devices, 2023–2025)

- People Flow (Untangling People Flow for Smart and Sustainable Urban Environments, 2023–2026)

- Energy-Carbon-KOM (Development of energy-carbon coordinated key operation management technology of district energy system based on mechanism-data fused modeling, 2023–2026)

- HumanIC (Human – Centric Indoor Climate for Healthcare Facilities, 2024–2028)

- RESPED (Enabling Energy Resilience through new energy flexible and affordable PED concepts, 2024–2027).

Internal AI development and innovation

Artificial intelligence is used both in internal operating models and in the development of new commercial solutions. For internal use, Granlund uses the secure and self-developed artificial intelligence tool GraGPT. The training aims to ensure that all employees understand the possibilities and uses of artificial intelligence in different areas of business.

Granlund offers applications that utilise artificial intelligence, such as AI Energy Survey and Granlund Manager’s AI features.

Business Finland’s IML4E project, which ended at the end of the year, created an AI platform that uses machine learning to develop and maintain AI applications, such as reading the text content of technical documents. In the first phase, the application has been used to review hundreds of documents related to LCA calculations and circular economy surveys.

The possibilities of artificial intelligence in the use of text-based information and time series will continue to be investigated in 2025 with the seed funding of Technology Industries of Finland.

NSDC: Regional energy concept and nature footprint

The NSDC project developed a regional energy concept and examined its benefits compared to building-specific energy solutions and district heating.

During the project, summer trainees of middle school age were also invited to participate in discussions regarding the theme. Workshops provided young people with the opportunity to contemplate what a comfortable living environment and a future city block would look like.

Another of the research project’s themes was biodiversity and the natural footprint of construction, which were also studied at Granlund in a thesis.

Construction has a material impact on global biodiversity loss. The majority of the negative impacts on nature take place outside building sites, for example, in material production.

GenerIoT: Storm resistance of wind turbines

The GenerIoT project, which will continue until 2026, will implement three pilot projects where IoT sensors are used to collect information on the condition of wind turbines, mobile base station masts and the technologies used in indoor environments.

Conducted at Granlund, the thesis examined the proactive condition management of wind turbines. The modelling took into account factors such as the dynamic stress and bending of the wind turbine under different wind conditions.

E3: Cleaning the indoor air in daycare centers and hospitals

The E3 joint development project examined ways to clean indoor air from airborne pathogens. Correctly sized and placed air purifiers reduced the number of children falling ill in daycare centres by approximately 18%. In hospital patient rooms, purifiers were used to achieve a level of clean air nearly comparable to isolation rooms.

Research in to indoor air solutions for hospitals continues in the EU HumanIC project.