Business and customers

Granlund’s business areas include design, construction management and supervision, consulting and services, software and real estate management. The company mainly operates in Finland with more than 1,500 experts. Granlund also has offices in Sweden and the UK.

Business overview

All in all, 2024 was a good year for Granlund’s business operations. Most significant growth took place in the data center sector, construction management and supervision as well as property software. Design services were also in demand, albeit some variation occurred between different design sectors. In MEP design, we maintained our position as the market leader.

The customer satisfaction and brand survey results were pleasing. On average, the customer satisfaction score increased from 2022 to 4.08 on a scale of 1–5.

Granlund’s largest customer accounts in 2024

- City of Helsinki

- Kesko Oyj

- Senate Properties

- Data center projects

- S Group

- Varma Mutual Pension Insurance Company

- YIT Corporation

- Wellbeing Services County of North Ostrobothnia

- Wellbeing Services County of Pirkanmaa

Our business areas

| Design | Services and consultancy | Construction management and supervision | Software | Real estate management |

|---|---|---|---|---|

| We are the Finnish market leader in MEP design. We are also expanding in architectural and structural design. MEP design is our largest business area. In recent years, we have also expanded our services to entail architectural and structural design so as to be able to provide our customers with comprehensive services. Read more | We offer property, energy and sustainability consultancy for existing properties and construction projects alike. We support our customers with the green transition and help them achieve their sustainability goals. Our property management consultants can help with managing the technical lifecycle of properties. Read more | Construction management is one of our strongest growth areas. Our expertise covers construction management, supervision as well as project management services. We can also help with operational verification and commissioning on the threshold of project completion. In addition, we provide cost control and calculation services as well as 4D design to support scheduling. Read more | Our main software product is Granlund Manager. The most popular property management software in Finland, it can be used to monitor, e.g. property maintenance and energy consumption. The software musters all essential property data in one place. Granlund Designer is a construction data standardisation and management tool. It introduces transparency into construction projects. Read more | We provide real estate management services in Greater Helsinki via Granlund Isännöinti. Our services include the housing company’s responsible property manager, financial administration services as well as technical property management. We also provide expert services to support the housing company’s renovation design. Read more |

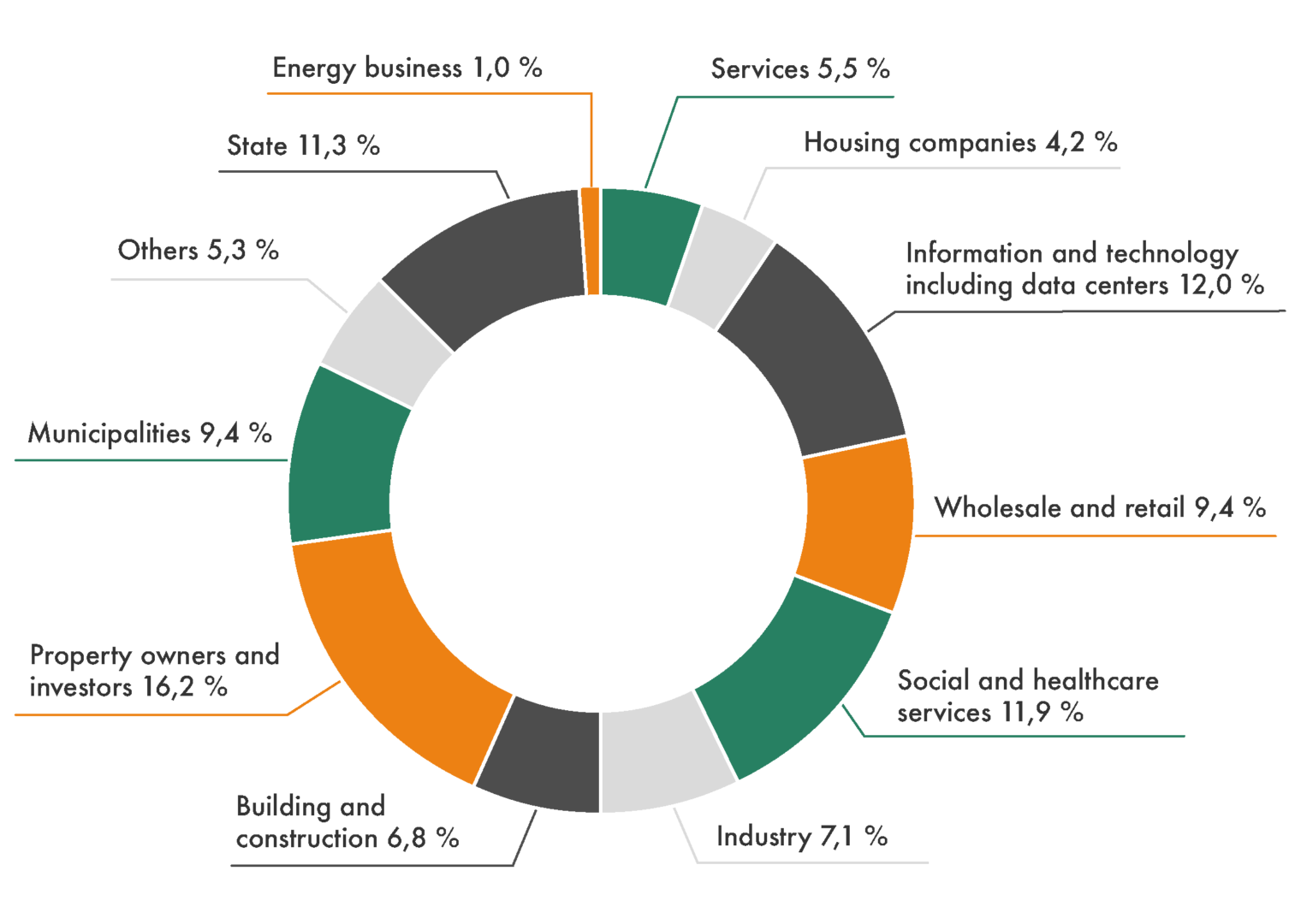

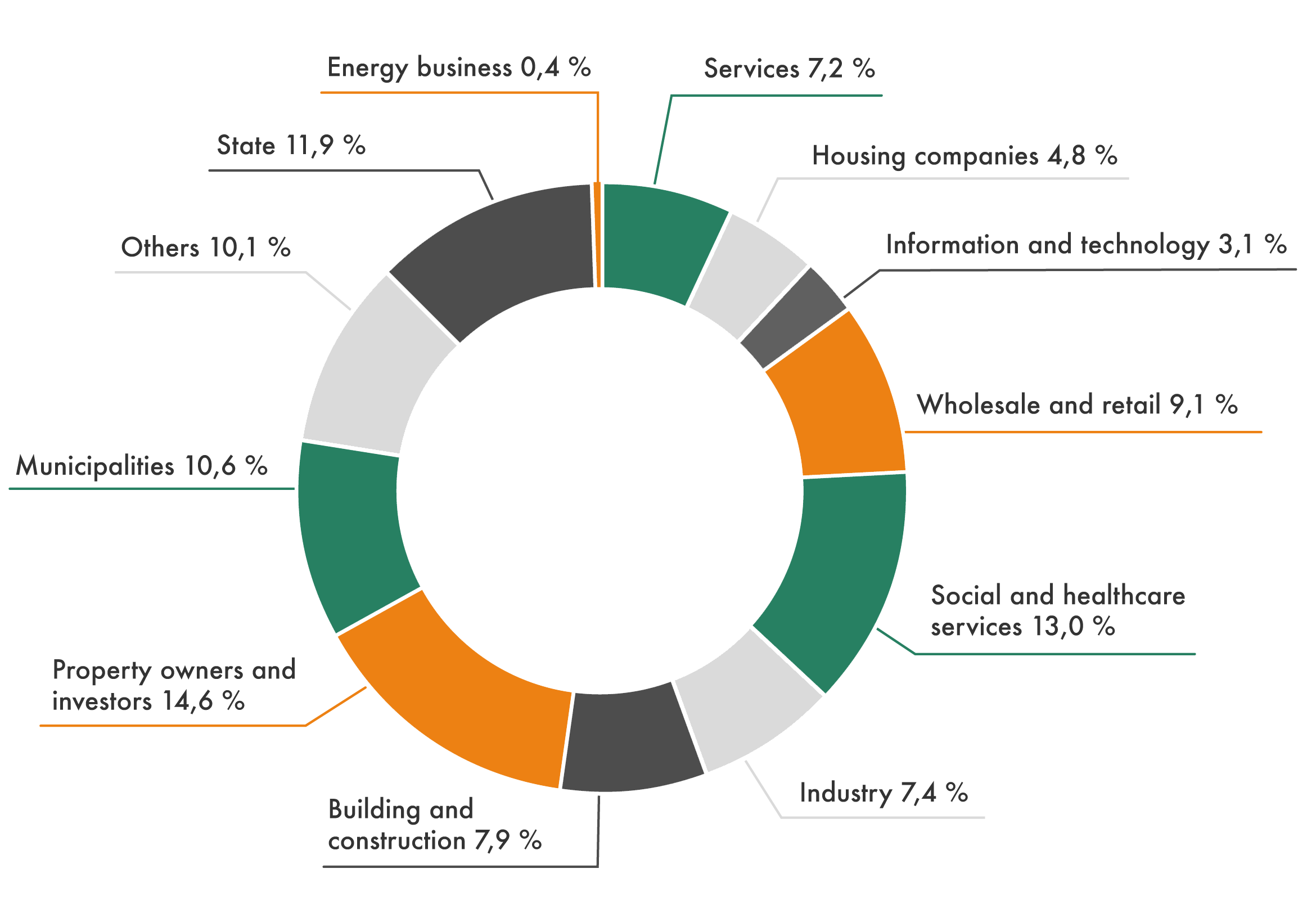

Our customer segments

In 2024, Granlund’s customer segments remained largely unchanged from 2023. That being said, the strong growth in the data center sector is clearly evident in the greater number of information and communications segment.

Design business

Granlund’s services include MEP design, structural and architectural design. The company specialises in technically demanding projects, such as hospitals and data centers. In addition, services are offered in several special areas of design.

Due to the market situation, the demand for design varied greatly

between business units and regions. The whole year was busy in Ostrobothnia, but the situation was more challenging in Lahti and Oulu, for example. More projects were launched in the public sector than in the private sector. The market leader position was maintained in MEP design, and major projects continued to be emphasised in hospital design.

The most important successes were the continuation of long-term customer relationships and good customer feedback. The volume of data center projects doubled, some new progress was made in industrial design, and the newer businesses structural and architectural design grew in line with the targets.

Granlund’s strength in the market situation was special expertise and creating added value for the entire building lifecycle. Renovation accounted for a stable share of the total business volume. The demand for high-quality design data and data-driven services is clearly growing.

MEP design is Granlund’s largest business area and the company is a market leader in the field. Business profitability in 2024 remained good, but the competition became clearly tougher during the year.

The electrification of society increased the demand for electrical design compared to HVAC design. Many different electricity-based energy and charging systems were planned during the year. Stricter energy and sustainability reporting requirements increased the need for building automation design. Renovations of automation systems were also carried out as separate projects.

Many of the most significant projects of the year were alliances that extensively employed MEP designers. Data centers, industrial properties and high-security properties also provided an important workload.

In architectural design, Granlund developed strongly and the volume of operations grew strongly. During the year, Granlund’s architects were employed in data center, industrial and school projects and other public projects, for example.

In addition to recruitments, successful acquisitions were made. Late in the year, the merger of Raami Architects with Granlund strengthened the expertise in the architectural design of hospitals. At the same time, the number of employees increased from 40 to approximately 80. The growth enables the joint design of increasingly large projects and responding to the increasingly strict reference requirements of the industry.

Architectural design is now carried out nationwide at six locations. The long-term goal is to increase the number of employees in one of Finland’s three largest architectural offices.

In spite of the general market situation, Granlund’s structural designers had plenty of work in renovation in the retail and industrial sectors, data centers and alteration and maintenance projects.

The strategy created in the spring was aimed at growth and providing special structural design expertise for demanding projects together with other design sectors. The number of employees tripled and the business expanded from Mikkeli and Lappeenranta to Joensuu, Kuopio, Tampere, Hämeenlinna, Espoo and Helsinki.

Recruitments strengthened special expertise in areas such as wood construction, building physics, carbon footprint optimisation and digital technologies, the need for which will increase as the Building Act is revised.

In 2025, the aim is to continue growth and also carry out acquisitions.

Special design services cover lighting, AV and presentation technologies, fire safety engineering, telecommunications and safety technology, cleanrooms, refrigeration technology, securing electricity supply, professional kitchens and fixed hospital equipment.

Versatility proved to be Granlund’s strength. Professional kitchen design grew and the focus of cleanroom design shifted from healthcare to industry. The greatest demand was in electrical engineering-related services, such as AV, telecommunications and lighting design. Fire extinguishing system designers were busy with data centers. On the other hand, the year was more challenging in refrigeration technology and fixed hospital equipment design.

The current global situation increased the need for security design. Throughout the projects, the emphasis was placed on high-security operating methods and confidential data processing.

The Finnish hospital design market reflects that a large proportion of the country’s university and central hospitals have been built. Major projects will continue, but construction will focus more on alteration and renovation projects, psychiatric hospitals and health and wellbeing centers.

During the year, Granlund’s hospital designers were busy with the Laakso Joint Hospital alliance, which was in its most intense phase, and the launch of the Tampere University Hospital modernisation programme. The wellbeing services county reform continued to be reflected in the business, and new implementation methods, such as the lease project model, were experimented with in projects.

The focus will gradually be shifted to the international market. Granlund is a member of the Finnish Integrated Hospital Design Alliance IHDA, which also designs hospital projects internationally.

The pace of data center construction was exceptionally high during the year. The development of artificial intelligence boosted the growth of Granlund’s data center operations to an all-time high, which strengthened its position as a market leader in the Nordic countries.

In data center services, the tasks of the pre-planning phase, such as site assessments and plot due diligence, were emphasised more than before. High-quality work in the project planning phase resulted in additional work in the overall design of data centers as well as construction management and supervision.

The growth was addressed by recruiting new project management experts and by making more extensive use of the design resources of Granlund’s various business operations and subcontractors. A significant acquisition was also made in Sweden when K-Lab Projektering AB joined Granlund.

Going forward, the aim is to maintain the market position and quality of operations and continue sustainable growth.

The market for energy efficiency projects was more challenging than in previous years. Property owners only made mandatory investments, and most energy subsidies were discontinued.

The business developed services and created new implementation concepts for electrical energy demand response and smart electricity procurement. In addition, services were expanded from design and consulting to turnkey deliveries, in which Granlund is responsible for the entire project from project development and technical planning to implementation and operational assurance.

In energy design, reporting and calculation were automated with history data and data management. Individual project development phase preliminary studies were carried out in Sweden.

In 2025, growth is particularly expected from turnkey deliveries, which are transparent to customers, and new service concepts.

Design projects and customers

- Laakso Joint Hospital alliance, Helsinki

- Data center projects

- Tampere University Hospital modernisation programme, Tampere

- Myllypohja multi-purpose building alliance, Lahti

- Pasila central tower area (Varma), Helsinki

- Kuopio University Hospital, Uusi Sydän cardiac clinic alliance, Kuopio

- Roihupelto campus lifecycle project, Helsinki

- Kokkola Sports Park hybrid arena

- Hitachi Energy Park, Mustasaari

Construction management and supervision

Competition intensified in the construction management market, but Granlund’s net sales grew in line with the strategic goals. Recruitments were successful, and dozens of new employees were hired. Growth was supported by one acquisition in construction management.

The greatest successes of the year included excellent customer satisfaction and the expansion of business operations throughout the country. A construction management organisation was established for each of Granlund’s business units. Granlund’s reputation in construction management also improved in line with the strategy.

Renovation was the cornerstone of the business, although there was also local demand in new construction, housing companies and industry. In addition, construction management consultants and supervisors were busy with data centers and international projects, high-security and protected sites.

In different areas of construction management, Granlund performed well in the construction management and supervision of very demanding projects and renovations. Survey services had a quieter year.

Net sales from cost control and 4D services increased and supported data-driven project management, which is one of the strategic objectives of construction management. Going forward, volume and cost calculation will focus on cost control and the refinement of digital quantity data for carbon footprint calculation, for example. In 2025, an updated strategy will be implemented aiming at strong and profitable growth together with our customers.

The renovation market was characterised by caution, which was also reflected in the demand for survey services. Few extensive renovations were started, and projects minimised alteration work and spared building components. A positive side was the support for the circular economy and lower-carbon construction.

Granlund retained its position in renovation design and grew in electrical design, construction management and supervision. The number of employees increased to approximately one hundred. Customers appreciated Granlund’s comprehensive service and decades of experience in LTP repairs of buildings of different ages.

In 2025, the goal is to grow the renovation business in all sectors. The strongest growth is expected in construction management and supervision. The organisational changes aim to centralise the development of different areas and create the prerequisites for growth in line with the new department division.

Granlund’s data-driven services support the monitoring of the situation picture as well as budget and schedule control in the project management of the construction project phase.

In 2024, the awareness of 4D design increased significantly in the industry and net sales doubled. BIM-based scheduling was used, for example, in data center and industrial projects and in scheduling the planning of the Laakso Joint Hospital.

Cost control services expanded to include new customers. Granlund performed well in public tenders and secured significant new framework agreements. Growth will continue to be supported by establishing a separate department for cost control services in 2025. The aim is also to develop the use of digital quantity data in the control of construction projects.

Construction customer accounts

- Senate Properties

- City of Helsinki

- Varma Mutual Pension Insurance Company

- Sponda Oy

- Okmetic Oy, silicon wafer factory, Vantaa

- Laakso Hospital, Helsinki

- Prysmian Group Finland Oy: Pikkala cable factory, Kirkkonummi

- Data center projects

- International projects

- Retail projects

- Municipal sector

XTX Markets builds a large-scale data center in Northern Finland

One of the major projects of the year was the data center of XTX Markets that is being build in Kajaani, Northern Finland. XTX Markets plans to invest over €1bn to develop a state-of-the-art data center complex. The construction of the first data center has begun and is planned to be completed in 2026.

Granlund joined the project during the project study phase in spring 2023. “Our cooperation started with concept design and a technical due diligence study, which verified, among other things, the selection of the site and the framework for the implementation of the data center,” says Jari Innanen, Director of data center business and Account manager of the project.

Consulting and services

There was a wait-and-see atmosphere in the consulting industry in 2024. The number of property sales was at a record low and price competition was savage. However, the market situation was refreshed by future legislative amendments that encouraged more efficient management and reporting based on business intelligence. The public sector in particular became aware of the importance of data in property maintenance, risk management and the use of resources.

In sustainability consulting, Granlund’s range of services was expanded and demand increased towards the end of the year. The demand for sustainability services in the building product industry grew significantly. In energy consulting and property management, the growth targets were not met in all respects. However, the continuous services offered to regular customers kept the experts busy. Property owners’ sustainability and climate goals were emphasised in property management.

Long-term customer loyalty remained strong, and dozens of new customers were secured in all sectors, from municipalities and parishes to industry and investors, with Granlund acting as a strategic partner. In addition to Southern Finland, the offering of consulting services has been growing in Eastern and Central Finland for years, and now Northern and Western Fin-land are also following suit. Granlund currently employs a total of approximately 150 energy and sustainability consultants.

In 2025, growth is expected in areas such as strategic sustainability consulting and data-driven services that improve business intelligence and productivity. Granlund’s AI product family already includes several ready-made tools that support both sustainability reporting and property maintenance control.

Although the property management market was characterised by uncertainty, the public sector in particular remained active and developed its business intelligence practices with the help of consultants. Property maintenance control was improved with Granlund’s AI-Capex calculation tool, for example.

Strategic partnership with loyal customers was emphasised in property management services. A large number of new customers were secured during the year, and they were offered maintenance and repair debt management services. Municipalities also needed support for the social and healthcare reform.

Although there were fewer surveys related to property transactions than before, there was demand for services related to the sustainability of properties and technical management. The surveys emphasised combining the maintenance, energy efficiency and sustainability perspectives.

The market situation was challenging during the year and price competition increased. Energy consulting did very well in the situation, even though growth was more modest than expected. Long-term customers remained and employee turnover was low. Energy consulting for construction projects remained at the previous year’s level.

Energy consultants were busy with continuous services offered to long-term customers, such as building services optimisation and energy management, which improve energy efficiency and indoor air quality. Significant new customer contracts were also signed in the Nordic countries. Interest in demand flexibility and district energy solutions is increasing.

Future growth is expected in data-based energy calculation services for demanding properties and property portfolios that utilise artificial intelligence tools, automation and analytics.

Granlund maintained its position as a versatile technical and strategic sustainability expert in the real estate and construction sector. The year was particularly good in sustainability services for construction projects and the construction product industry. A service solution was developed for the preparation of environmental product declarations (EPD) to produce more accurate data for customers.

Granlund’s range of sustainability consulting services expanded. In addition to environmental certificates, carbon calculations and circular economy consulting, there was demand for new services related to waste and CSRD reporting and biodiversity, for example. Our experts also worked as outsourced sustainability managers.

Customers have a growing need for strategic sustainability consulting in the real estate and construction sector and product industries, as well as for biodiversity, carbon footprint and sustainability targets in design and construction management.

Consulting and services customer accounts

- Varma Mutual Pension Insurance Company

- City of Helsinki

- Citycon Oyj

- HUS

- Senate Properties

- Sagax Finland Asset Management Oy

- Sähkötalo (Kamppi, Helsinki)

- Parishes

Software business

The tense economic situation was reflected in the software business in two ways. There were no major tenders and invest-ment decision-making times were long, but many parties also saw software solutions as a way to improve business productivity.

Global security threats emphasised the importance of cybersecurity. There is a demand for reinforced information security programs in addition to cloud services. Granlund’s software solutions have also been developed for high-security sites and IT environments for a long time.

The growth targets were achieved in all software products, which enabled a revision of the product development organisation and sales process. The sales organisations for domestic and international projects were merged, and the focus of international operations was on the Nordic and Baltic countries.

The demand for software is expected to continue to grow due to the new Building Act in Finland and tightening EU legislation. With software, property owners know what is happening in the buildings and can manage their operations more efficiently and report on it to different stakeholders.

Granlund Manager maintained its position as the most popular property management software in Finland. Important new accounts were acquired in Sweden and the first Spanish version of the software was created. In Finland, software services were actively deployed to customers through regional offices, and the use of software expanded throughout the country.

Over 80 new customers deployed Granlund Manager during the year. The software was delivered to parishes and wellbeing services counties, for example. Granlund Manager is also gaining a foothold as an industrial property management tool. The Granlund Manager partnership network was expanded and cooperation with existing partners was intensified. In addition, the first AI features for energy management were commissioned in the software.

The demand for the device information management software Granlund Designer increased during the year. The background was the digitalisation of the construction industry, which is catching up with other industries. Granlund Designer functions as the same type of data management tool in the planning and construction phase as Granlund Manager during the use of the building.

In addition to properties, the benefits of Granlund Designer were discovered in demanding industrial projects in particular. The software helps to meet the requirements of the new Building Act, for example, and digitalises many data management stages during a construction project.

Granlund Designer and Granlund Manager will also be commercialised as a whole in the future. Together, the software products offer a solution for data management throughout the property’s lifecycle.

Software business customer accounts

- Okmetic Oy, silicon wafer factory, Vantaa

- Kanta-Häme wellbeing services county (Oma Häme)

- Church Council of Finland framework agreement

- Vöfab, Sweden

- Baltic Yachts, Pietarsaari

Real estate management

There were exceptionally large mergers and acquisitions in the real estate management market during the year. In the past, acquisitions were focused on small and medium-sized companies in the industry, but now they were also made by the largest ones. This increased customer mobility and was reflected in the number of requests for quotes.

In real estate management, Granlund ranks among the 20 largest companies in Finland. Net sales and profitability improved in accordance with the strategic goals and we also managed to land new customers. Customers include housing companies, real estate companies and parking garages. There were no major changes in the head count; retired employees were replaced by recruitment and training of new experts.

During the year, preparations were made for the second phase of the National Land Survey of Finland’s apartment information system with system reforms and the appointment of a project group. In summer 2025, we will start exporting housing companies’ financial data and maintenance and alteration work data to the same database as ownership data.

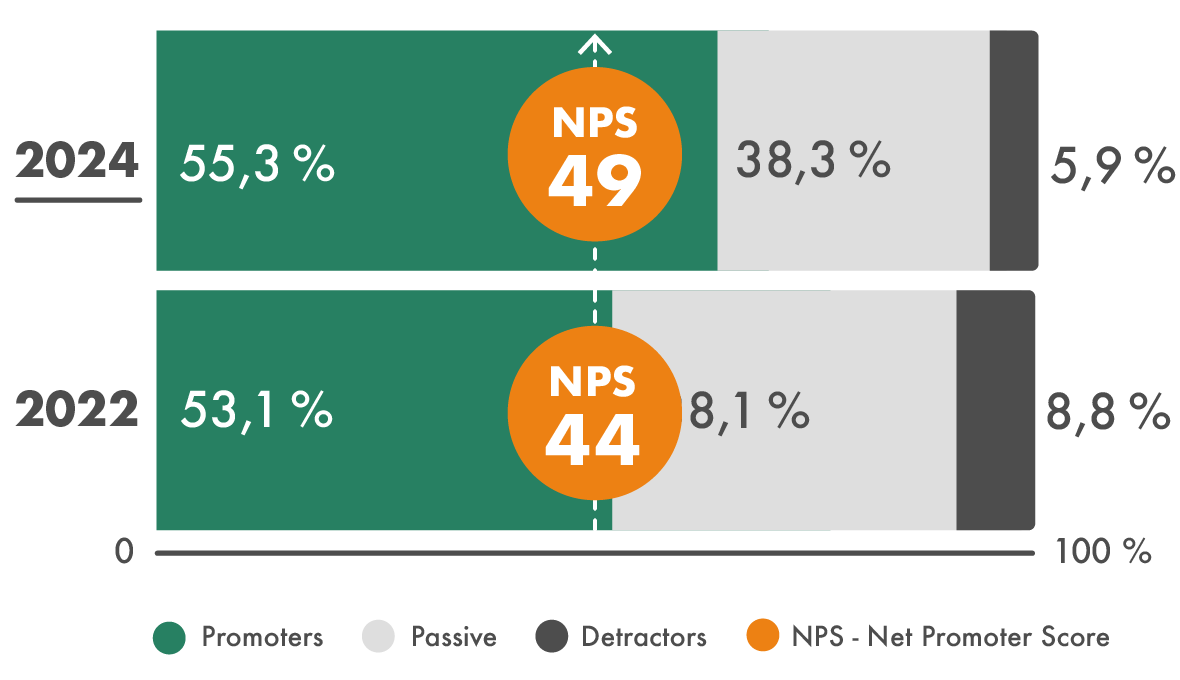

Customer satisfaction is measured regularly

At Granlund, customer satisfaction is measured every two years through a customer satisfaction survey and regularly through project feedback surveys. An extensive customer satisfaction survey and brand survey were carried out in autumn 2024.

Customer satisfaction with Granlund’s operations improved in all areas. A broad range of services, long-term customer relationships and an understanding of customers’ needs laid the foundation for the good results. Customers particularly appreciate Granlund’s extensive expertise and expertise as well as local services.

Customer satisfaction survey results

Granlund prepared for the challenging economic situation in the industry by developing active sales work. Customer visits and other contacts increased by more than 30 per cent. It yielded results, even though the aim of the contacts was not direct sales, but understanding customers’ needs. The approach was also reflected in the survey results.

The NPS (Net Promoter Score) for the entire Granlund Group increased to 49 (44 in 2022), and the overall satisfaction score was 4.08 (scale 1–5). The increase was a few tenths of a per cent. Overall satisfaction improved in all businesses. For the second time in a row, the highest customer satisfaction was achieved in construction management and supervision (4.27), and the second best result was achieved in MEP design (4.15). Both improved from the previous survey.

Granlund’s mentioned strengths included expertise, availability of contact persons, understanding of customer needs, price-quality ratio and responsible business conduct.

55 per cent of customers would recommend Granlund. Managers of customer companies were the most likely to recommend Granlund.

Granlund’s mentioned strengths included expertise, availability of contact persons, understanding of customer needs, price-quality ratio and responsible business conduct.

Customer feedback is also requested regularly after the end of projects. The project feedback NPS was 65 (in 2023, it was 68).

The customers particularly appreciated Granlund’s expertise and smooth cooperation. In recent years, adherence to project schedules has also been successfully improved.